What information do I need for a property quote?

Overview

In insurance, underwriters typically ask agents for construction, occupancy, protection class, and exposure (COPE). In addition to asking their clients for property information, insurance agents can utilize various internet resources to determine critical property information.

Construction

The type of materials l) and the quality of construction impact the building's resilience to hazards like fire, wind, and earthquakes. Understanding these construction types helps evaluate properties' structural integrity, fire resistance, and overall risk profile, guiding both insurance underwriting and risk management practices:

1. Frame (Class 1)

Description: Buildings with exterior walls made of wood or other combustible materials such as shingles, clay, concrete tiles, BUR (built up roof with gravel or modified bitumen), single-ply membrane

Characteristics: Typically includes wood studs, joists, rafters, and floors.

Risk Factors: High fire risk due to combustible materials.

Commonly Found: Habitational, max 3-4 stories

2. Joisted Masonry (Class 2)

Description: Buildings with exterior walls made of non-combustible materials (such as brick, concrete, stone, or tile) and roofs and floors made of combustible materials (like wood, stucco, brick veneer, painted CB, or EIFS exterior cladding).

Characteristics: Combines the fire-resistant exterior walls with combustible interior components. Mostly noncombustible.

Risk Factors: There is a lower fire risk than frame construction, but it is still significant due to the wood joists.

Commonly Found: Habitational, max 3-4 stories and small office/retail

3. Non-Combustible (Class 3)

Description: Buildings with exterior walls, floors, and roofs made and supported by non-combustible materials are common. Typical constructions include steel frame walls with masonry in-fill, brick veneer, metal sheathing, and EIFS. The steel framing serves as the load-bearing portion of the building frame. AMBS (all metal building system) pre-engineered construction is also widespread.

Characteristics: Typically uses metal or concrete for structural elements.

Risk Factors: Lower fire risk since primary structural components do not burn.

Commonly Found: Warehouses, manufacturing facilities

4. Masonry Non-Combustible (Class 4)

Description: Predominant buildings have exterior walls made of masonry and roofs and floors made of non-combustible materials. These may include concrete blocks, reinforced masonry, and tilt-up concrete load-bearing walls, often used in conjunction with heavy steel framing.

Characteristics: Often includes brick or block walls with steel roof and floor supports.

Risk Factors: Even lower fire risk due to non-combustible materials used throughout the structure.

Commonly Found: Shopping centers, strip centers, office buildings, warehouses, and schools

5. Modified Fire-Resistive (Class 5)

Description: Buildings are constructed with fire-resistant materials capable of withstanding high temperatures for a limited period, typically up to two hours. These structures often feature protected steel and/or concrete, as well as heavy masonry walls and floors, and are designed to be semi-windproof.

Characteristics: Uses fire-resistive construction techniques, but not to the same extent as fully fire-resistive buildings.

Risk Factors: Moderate fire resistance, providing additional protection compared to standard non-combustible buildings.

Commonly Found: High and mid-rise office buildings and condos

6. Fire-Resistive (Class 6)

Description: Buildings are designed to endure severe fire exposure for a considerable duration, typically at least two hours. The construction involves a reinforced concrete frame and floors, or highly protected steel and concrete. The floors are a minimum of 4 inches of cast-in-place concrete, precast concrete, or concrete on protected steel. Wind-resistant precast construction is transported from other locations, while cast-in-place concrete is poured on-site.

Characteristics: Uses non-combustible materials with high fire resistance, such as reinforced concrete and protected steel.

Risk Factors: Lowest fire risk, providing the highest level of protection against fire damage.

Commonly Found: High-rise office buildings and condos, parking garages

Additional Construction Types

Heavy Timber (Class 7)

Description: Buildings constructed with large wooden beams and columns are often seen in older industrial buildings.

Risk Factors: Better fire resistance than frame buildings due to the mass of the wood, which burns slower.

Mixed Construction

Description: Buildings that use a combination of different construction types.

Risk Factors vary depending on the materials and methods used; insurers may assess risk based on the dominant construction type.

Special Considerations

High-rise buildings Often have additional classifications or considerations due to their height and occupancy types.

Historic Buildings: May fall under specific categories due to preservation requirements and unique construction materials or methods.

Roof Type

The type of roof is a critical factor in determining the risk associated with a building. Different roof types offer varying levels of protection against hazards like fire, wind, hail, and water damage. Here are some common roof types explained:

1. Asphalt Shingle Roofs

Description: Made of fiberglass or organic mat coated with asphalt and granules.

Characteristics:

Durability: Typically lasts 15-30 years.

Cost: Relatively low cost.

Fire Resistance: Moderate.

Wind Resistance: Moderate; vulnerable to high winds if not properly installed.

Insurance Considerations: Generally considered a standard risk; some insurers may have concerns in high-wind areas.

2. Metal Roofs

Description: Made from various metals like steel, aluminum, or copper.

Characteristics:

Durability: Can last 40-70 years.

Cost: Higher upfront cost, but lower lifetime maintenance.

Fire Resistance: Excellent.

Wind Resistance: High wind resistance; good in areas prone to hurricanes or storms.

Insurance Considerations: Often favorable due to durability and resistance to fire and severe weather.

3. Tile Roofs

Description: Made from clay or concrete tiles.

Characteristics:

Durability: Can last 50-100 years.

Cost: High initial cost.

Fire Resistance: Excellent.

Wind Resistance: Good, but tiles can be heavy and may require additional structural support.

Insurance Considerations: Favorable for fire resistance but may have higher repair costs if damaged.

4. Wood Shake/Shingle Roofs

Description: Made from natural wood, typically cedar.

Characteristics:

Durability: Lasts 20-40 years.

Cost: Moderate to high.

Fire Resistance: Poor, unless treated with fire-resistant chemicals.

Wind Resistance: Moderate; can be vulnerable to wind and hail.

Insurance Considerations: Higher risk due to fire susceptibility; some insurers may charge higher premiums or have restrictions.

5. Slate Roofs

Description: Made from natural stone slate.

Characteristics:

Durability: Can last over 100 years.

Cost: Very high initial cost.

Fire Resistance: Excellent.

Wind Resistance: Good, though heavy weight requires strong structural support.

Insurance Considerations: Favorable due to longevity and fire resistance, but higher repair costs and structural requirements.

6. Flat Roofs

Description: Roofs with a minimal slope, often covered with membranes like rubber (EPDM), built-up roofing (BUR), or modified bitumen.

Characteristics:

Durability: Varies by material; BUR lasts 15-30 years, EPDM 20-25 years.

Cost: Moderate.

Fire Resistance: Varies by material; generally good.

Wind Resistance: Varies; flat roofs can be prone to water pooling and leaks.

Insurance Considerations: May be seen as higher risk for water damage due to poor drainage, but generally stable against high winds.

7. Composite/Synthetic Roofs

Description: Made from a blend of materials, such as rubber, plastic, and polymer.

Characteristics:

Durability: Lasts 30-50 years.

Cost: Moderate to high.

Fire Resistance: Good.

Wind Resistance: High wind resistance.

Insurance Considerations: Often viewed favorably due to durability and weather resistance, though relatively new on the market.

8. Green Roofs

Description: Covered with vegetation and soil over a waterproof membrane.

Characteristics:

Durability: Varies; well-maintained green roofs can last 40+ years.

Cost: High initial cost, potential for energy savings.

Fire Resistance: Good, provided vegetation is well-maintained.

Wind Resistance: Generally good, but requires proper installation.

Insurance Considerations: Can be seen as environmentally friendly and beneficial for energy efficiency, but may involve higher maintenance and specific structural requirements.

9. Thatched Roofs

Description: Made from dry vegetation such as straw, water reed, or palm fronds.

Characteristics:

Durability: Lasts 20-30 years with proper maintenance.

Cost: High due to specialized labor.

Fire Resistance: Poor, unless treated with fire retardants.

Wind Resistance: Moderate; traditionally susceptible to high winds without proper construction techniques.

Insurance Considerations: High fire risk; often higher premiums or special conditions.

10. Solar Roofs

Description: Roofs equipped with solar panels or solar shingles.

Characteristics:

Durability: Solar panels typically last 20-25 years.

Cost: High initial cost, potential energy savings.

Fire Resistance: Panels themselves are non-combustible, but installation must be done correctly to avoid electrical fires.

Wind Resistance: Good, with proper installation.

Insurance Considerations: Can lower overall energy costs; some insurers offer discounts for sustainable features but may require specific endorsements or add-ons.

Plumbing Type

The type of plumbing in a building is an important factor for assessing risk and determining premiums. Different plumbing materials have varying levels of durability, resistance to leaks, and overall lifespan. Here are the common plumbing types explained:

Copper Plumbing

Description: Copper pipes are durable and have been used for decades in residential and commercial buildings.

Characteristics:

Durability: Long-lasting, typically over 50 years.

Resistance: Resistant to corrosion, bacteria, and UV rays.

Cost: Higher initial cost compared to other materials.

Installation: Requires soldering, which can be labor-intensive.

Insurance Considerations: Generally viewed favorably due to its durability and resistance to leaks and bursts. However, insurers may consider the potential for corrosion in certain water conditions.

2. PEX (Cross-Linked Polyethylene) Plumbing

Description: PEX is a flexible plastic piping used in modern plumbing systems.

Characteristics:

Durability: Long-lasting, typically over 40-50 years.

Resistance: Resistant to corrosion, scale, and chlorine.

Cost: Lower initial cost and easier installation compared to copper.

Installation: Flexible, requiring fewer fittings and joints, reducing the likelihood of leaks.

Insurance Considerations: Often viewed favorably due to ease of installation, flexibility, and resistance to corrosion. It may be considered less durable than metal piping in extremely high temperatures.

3. PVC (Polyvinyl Chloride) Plumbing

Description: PVC pipes are commonly used for waste and vent pipes, but not typically for hot water supply.

Characteristics:

Durability: Long-lasting, typically over 50 years.

Resistance: Resistant to corrosion and chemical damage.

Cost: Lower cost compared to copper.

Installation: Easy to install with solvent welding.

Insurance Considerations: Generally favorable for waste and vent systems due to its resistance to chemical and corrosion damage. Not typically used for potable water in homes, so less relevant for water supply risk.

4. CPVC (Chlorinated Polyvinyl Chloride) Plumbing

Description: Similar to PVC, but treated to withstand higher temperatures, making it suitable for hot water supply.

Characteristics:

Durability: Long-lasting, typically over 50 years.

Resistance: Resistant to corrosion, high temperatures, and chemical damage.

Cost: Higher than PVC but lower than copper.

Installation: Easy to install with solvent welding.

Insurance Considerations: Favorable due to durability and resistance to corrosion and heat. Suitable for both hot and cold water supplies.

5. Galvanized Steel Plumbing

Description: Steel pipes coated with a layer of zinc to prevent rusting.

Characteristics:

Durability: Lasts about 20-50 years.

Resistance: Prone to corrosion and rust over time, which can lead to reduced water flow and leaks.

Cost: Moderate initial cost.

Installation: Requires threading and cutting.

Insurance Considerations: Less favorable due to susceptibility to corrosion and potential for lead contamination in older systems. Often seen as higher risk for leaks and bursts.

6. Cast Iron Plumbing

Description: Heavy, durable pipes traditionally used for drainage and waste systems.

Characteristics:

Durability: Long-lasting, typically over 50-100 years.

Resistance: Highly resistant to wear and noise reduction.

Cost: Higher cost and labor-intensive installation.

Installation: Requires specialized tools and skills.

Insurance Considerations: Generally favorable for waste systems due to its durability and resistance to wear, but the high cost and labor required for repairs can be a consideration.

7. Polybutylene (PB) Plumbing

Description: Plastic piping used from the 1970s to the mid-1990s but no longer installed due to failure issues.

Characteristics:

Durability: Known for high failure rates, especially when exposed to chlorine in water.

Resistance: Poor resistance to degradation and cracking.

Cost: Low initial cost but high replacement cost.

Installation: Easy to install, but prone to leaks.

Insurance Considerations: Highly unfavorable due to known issues with leaks and failures. Often requires replacement, and insurers may charge higher premiums or exclude coverage if not replaced.

Insurance Considerations for Plumbing Types

When underwriting property insurance, insurers evaluate the type and condition of the plumbing system to assess potential risks such as leaks, bursts, water damage, and mold. Key factors include:

Age of Plumbing System: Older systems, especially those made of galvanized steel or polybutylene, are more likely to have issues.

Material: Materials like copper, PEX, and CPVC are generally preferred for their durability and resistance to common issues.

Installation Quality: Poor installation can lead to higher risk regardless of the material.

Maintenance: Regular maintenance and timely replacement of old or damaged pipes can mitigate risk.

Building Age

The age of a building plays a critical role in determining property insurance premiums and coverage terms. Older buildings typically face higher premiums due to increased risks associated with structural integrity, outdated systems, and higher maintenance needs. However, proper maintenance, renovations, and updates can help mitigate these risks and potentially lower insurance costs. Insurers take these factors into account to accurately assess the risk and determine appropriate coverage for the property. Insurance agents can find the age of the building from the property owner or through reliable real estate or county websites.

Occupancy

Occupancy is a fundamental factor in property insurance as it directly influences the risk profile, coverage requirements, and premium rates of the insured property. Accurate and detailed information about the occupancy type helps insurers provide appropriate coverage and manage potential risks effectively.

Common Occupancy Types

Residential Occupancy:

Single-family Homes: Standalone residential buildings designed for one family.

Multi-family Homes: Includes duplexes, triplexes, and apartment buildings housing multiple families.

Condominiums: Individual units within a larger building or complex, where each unit is separately owned.

Rentals: Properties rented out to tenants, which can include single-family homes, apartments, and condos.

Commercial Occupancy:

Office Buildings: Structures used primarily for conducting business activities.

Retail Stores: Buildings used for selling goods to consumers, such as shops, malls, and boutiques.

Restaurants: Establishments where food and beverages are prepared and served to customers.

Hotels/Motels: Buildings providing lodging services to travelers and guests.

Warehouses: Structures used for storage of goods and materials.

Industrial Buildings: Facilities used for manufacturing, processing, or distribution of goods.

Mixed-Use Occupancy:

Buildings that combine residential, commercial, and/or industrial uses within the same structure. For example, a building with retail shops on the ground floor and apartments on the upper floors.

Vacant or Unoccupied Properties:

Properties that are not currently in use or have been left empty. These pose higher risks for vandalism, theft, and undetected damage, often resulting in higher insurance premiums or specific policy conditions.

Protection Class

The Protection Class, also known as Fire Protection Class or Fire Insurance Rating, is a system used by insurance companies to evaluate the fire protection capabilities of a community or area. This rating is determined based on factors related to fire suppression and prevention services available in a specific geographic region. These ratings are important in setting insurance premiums for property owners.

Protection Class Ratings

Protection Class ratings typically range from 1 to 10, with Class 1 being the highest level of fire protection and Class 10 indicating minimal or no fire protection services. Here's what each rating generally signifies:

Lower Protection Class (1 or 2): Excellent fire protection capabilities, including quick response times, well-equipped fire departments, abundant water supply, and effective fire prevention programs. Properties located in areas with higher Protection Class ratings (e.g., Class 1 or 2) typically qualify for lower insurance premiums since they benefit from better fire protection services.

Higher Protection Class (9-10): Limited or no fire protection services available. Properties in Class 10 areas usually face the highest insurance premiums due to increased risk. Properties in areas with lower Protection Class ratings (e.g., Class 9 or 10) may face higher insurance premiums due to increased risk of fire-related losses.

You can find a full breakdown of accessing Protection Classes here.

Exposures

In property insurance, "exposures" refer to the various risks or potential sources of loss that an insurance company considers when assessing the risk associated with insuring a particular property. These exposures are crucial in determining the likelihood and potential severity of claims, which in turn influence the insurance premium and coverage terms. Here are the key aspects of exposures in property insurance quotes:

Types of Exposures in Property Insurance

Natural Hazards:

Flood: Risk of water damage due to overflowing rivers, heavy rain, or storm surges.

Earthquake: Potential for damage from seismic activity.

Windstorm: Exposure to high winds from hurricanes, tornadoes, or other storms.

Hail: Risk of damage from hailstones, particularly in regions prone to severe thunderstorms.

Wildfire: Potential for damage from wildfires, especially in dry, forested areas.

Review FEMA website: Natural Hazards | National Risk Index (fema.gov)

Man-Made Hazards:

Theft and Vandalism: Risk of property damage or loss due to criminal activities.

Fire: Potential for damage from accidental fires, including those caused by electrical issues or heating equipment.

Liability Risks: Exposures related to accidents or injuries occurring on the property that could result in liability claims.

Location-Based Exposures:

Proximity to Hazardous Areas: Closeness to high-risk areas such as flood zones, earthquake fault lines, or industrial sites.

Neighborhood Crime Rates: Higher crime rates can increase the risk of theft and vandalism.

Distance to Fire Services: Proximity to fire stations and hydrants affects the ability to quickly respond to and suppress fires.

Building-Specific Exposures:

Construction Type: The materials and methods used in construction, such as frame, masonry, or fire-resistant construction, affect the property's resilience to hazards.

Age of Building: Older buildings may have outdated electrical, plumbing, or structural components that increase risk.

Roof Condition: The type and condition of the roof can influence vulnerability to weather-related damage.

Occupancy: How the building is used (e.g., residential, commercial, industrial) impacts the types and levels of risk.

Operational Exposures (for Businesses):

Type of Business: Different businesses face varying levels of risk based on their operations (e.g., a restaurant has higher fire risk compared to an office).

Inventory and Equipment: High-value inventory or specialized equipment can increase the financial impact of a loss.

Step by Step Instructions

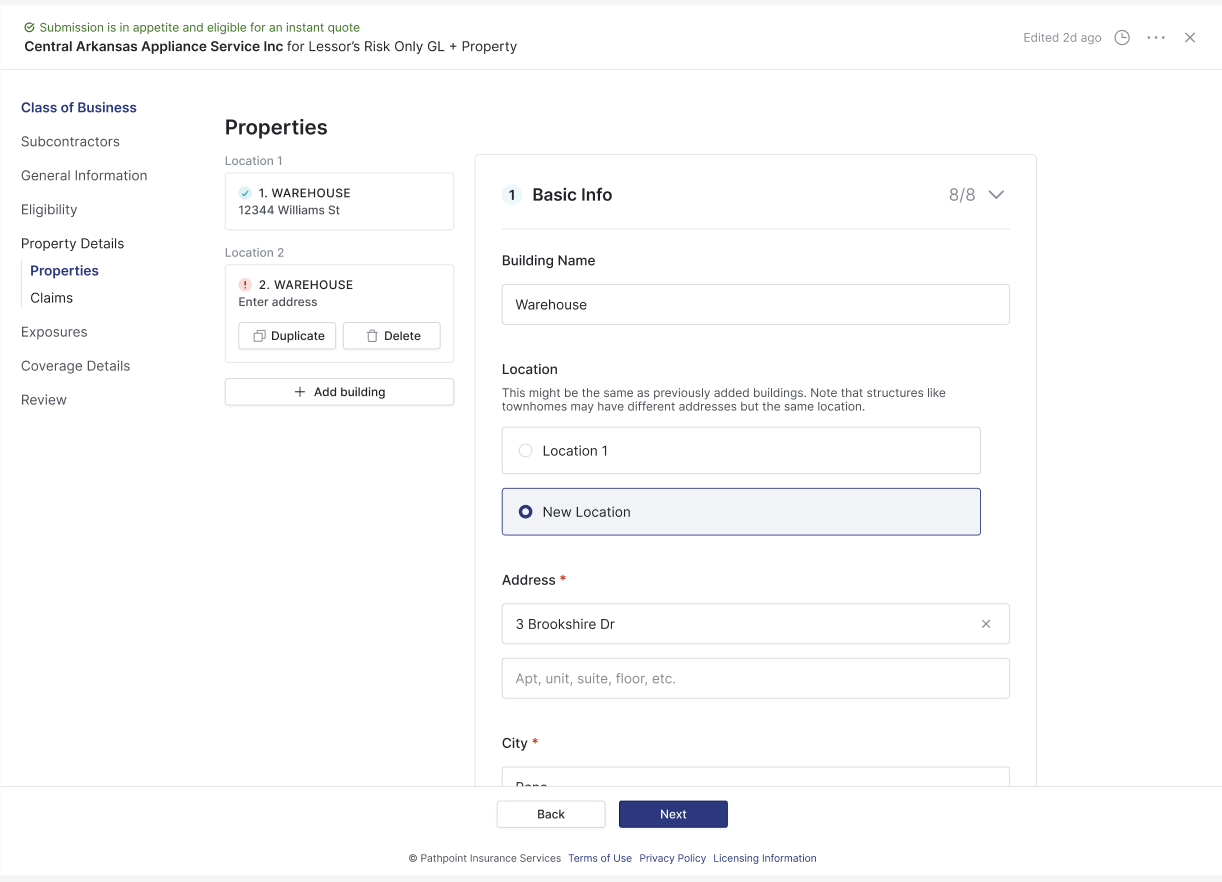

To quote property at Pathpoint, enter the basic property info, including the address, square footage, and number of stories.

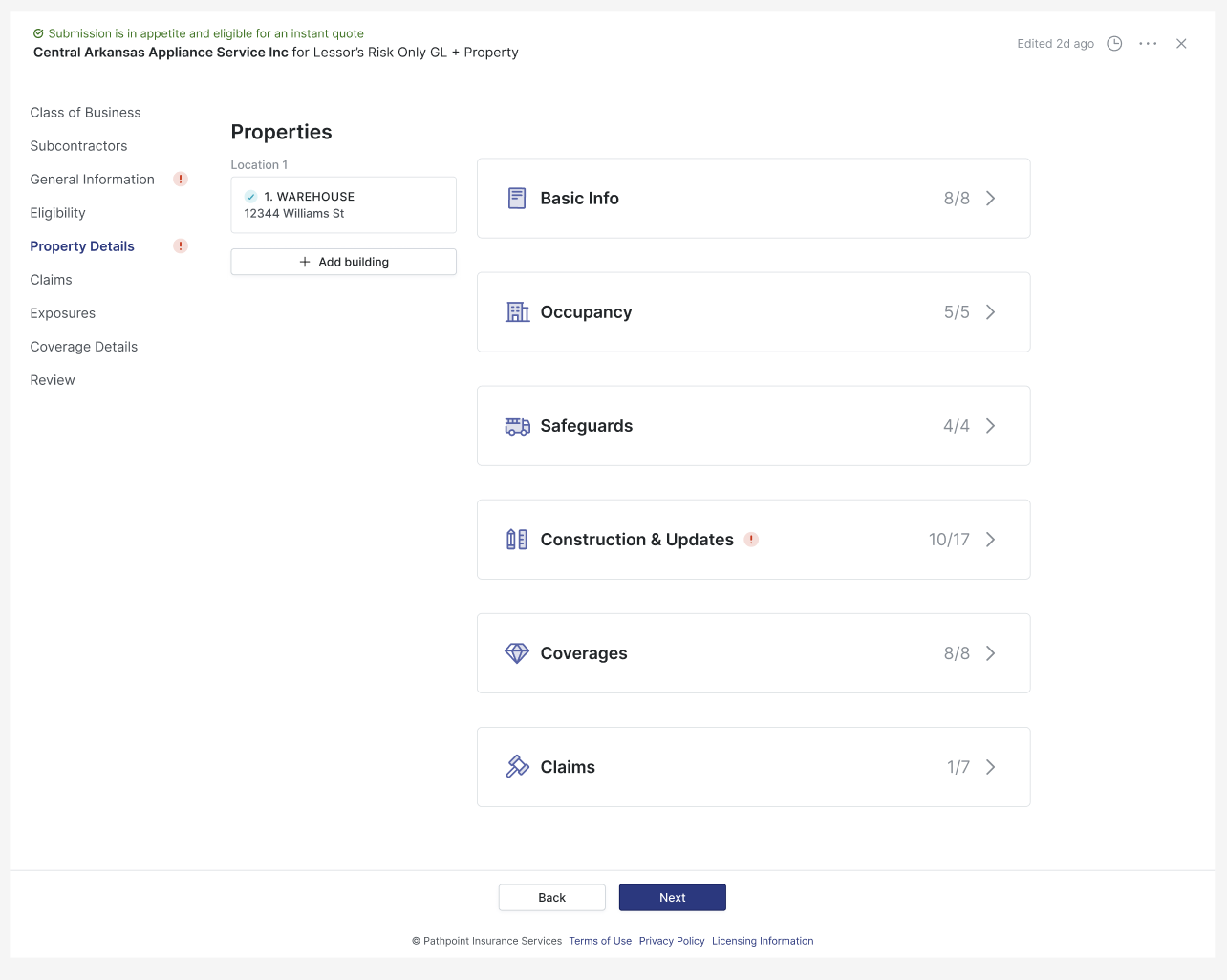

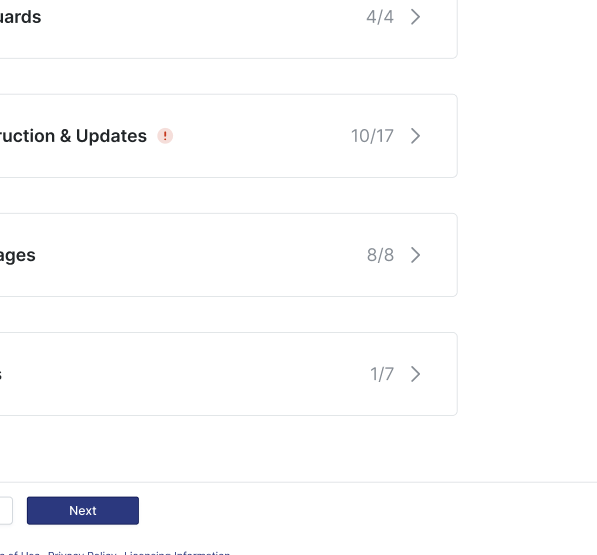

Next you will notice expandable sections to reorganize the questions by a common theme. (Occupancy, Safeguards, Construction & Updates, Coverages, and Claims)

The number of questions completed per section will be shown on the right to ensure completion.

When you’re done, hit Next

Watch a Demonstration

Related Articles

How do I quote business with Pathpoint?

What are the different Cause of Loss/Coverage forms?