How do I total Business Interruption?

What is Business Interruption?

Business interruption insurance is a type of coverage that provides financial protection to a business if it is unable to operate due to a covered peril, such as a natural disaster or fire. This insurance can help cover lost revenue, ongoing expenses, and additional costs incurred due to the interruption.

How to Total Business Interruption?

Business Interruption or Business Income is annual revenue minus expenses. When selecting the appropriate coinsurance percentage. Insurance agents determine the appropriate amount of business interruption coverage by considering factors such as the business's revenue, fixed costs, and potential for loss. They may also consider the potential duration of an interruption and the time it would take for the business to recover fully. It's important for agents to work closely with the business owner to accurately assess the potential risks and coverage needs.

Determining the Coinsurance Minimum

Property insurance uses coinsurance to keep rates fair. It standardizes the total insured value of properties, including the building, contents, and business income, based on factors like replacement cost or actual cash value. Rates are then applied against a set percentage of this value for each insured aspect. Rate adjustments consider factors such as deductible size, construction, and safety measures, impacting your insurance rates and emphasizing the importance of a safe and secure property.

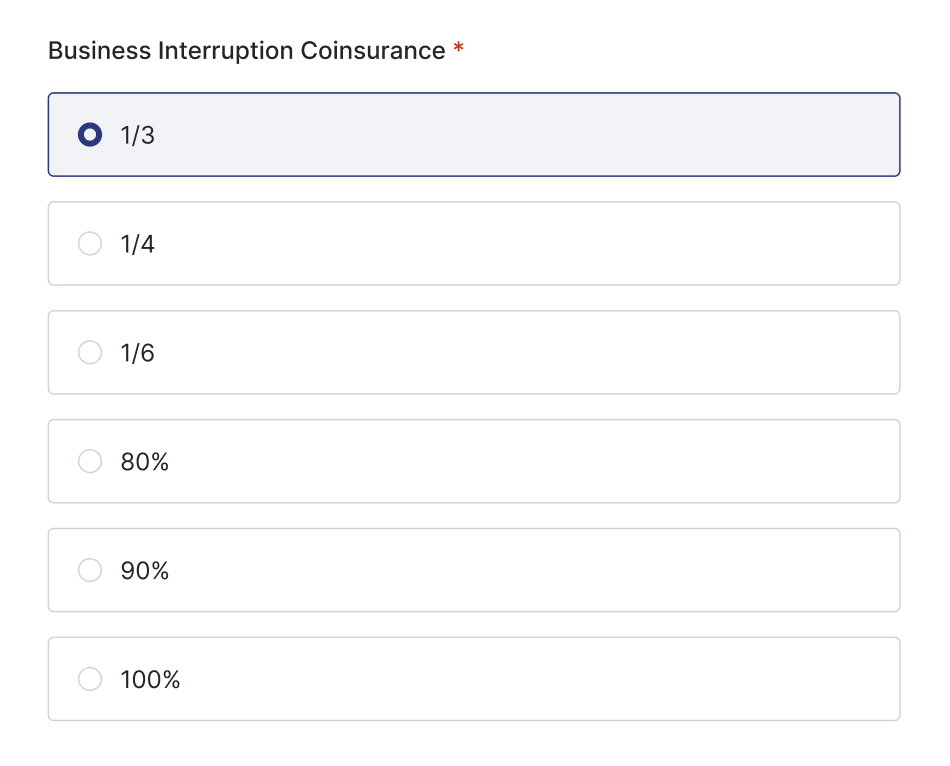

The ISO Business Income program offers the Monthly Limit of Indemnity option, allowing you to choose factors like 1/3, 1/4, or 1/6 on the declarations page. However, choosing 1/3 does not automatically mean you get three months of coverage. It's a way to avoid underinsurance risks when your financial situation is uncertain. Instead of specifying how extended coverage lasts, it sets a fixed amount paid each month.

Summary

In essence, Business Interruption Insurance aims to mitigate the financial impact of disruptions, allowing businesses to recover more quickly and resume normal operations without suffering significant financial setbacks.

Related Articles

Vacants (Buildings and Land; General Liability, Property and Package)