The insured canceled their policy. How can they expect their refund and when will they receive it?

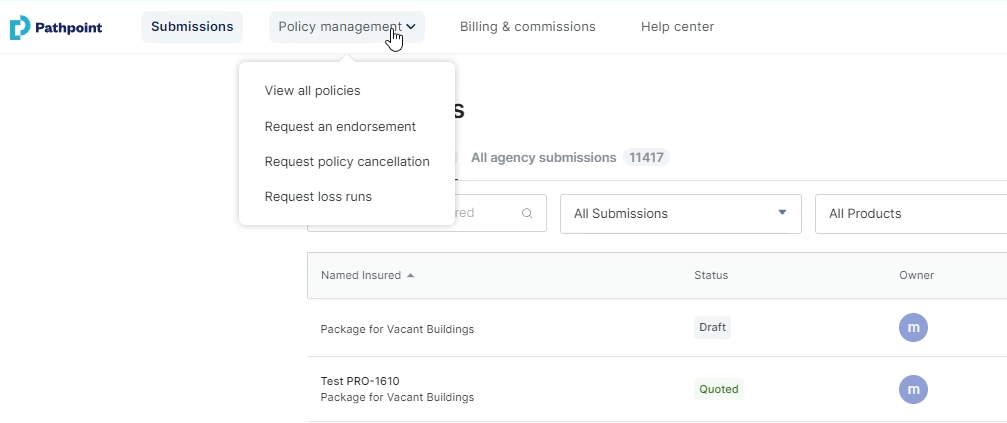

When an insured cancels their policy, Pathpoint will promptly initiate the refund process through Ascend. For voluntary cancellations, the agency should request cancellation via their dashboard by following these steps:

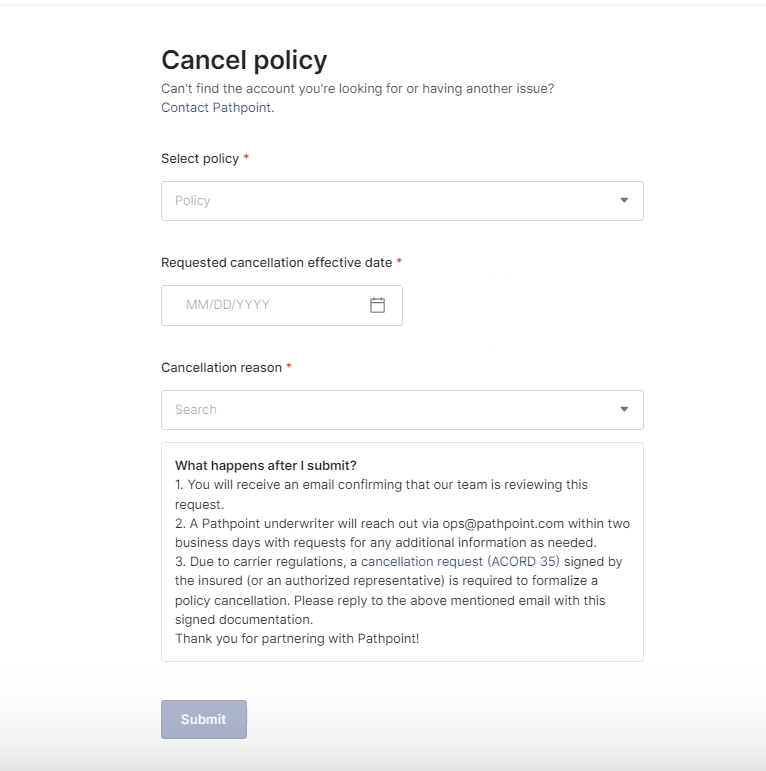

Select the policy you wish to cancel, the date, and reason.

When you hit Submit, you will see a green message that your request was received.

Once the policy is canceled and the cancellation invoice is received, the process for cancellation within PathPay (powered by Ascend) can proceed.

All funds, including any unearned commissions, must be returned to Pathpoint before a refund can be issued to the client.

Refunds are typically processed within 30 days from the cancellation of the policy, contingent upon the return of funds to Pathpoint.

For policies that were financed, any return funds will first apply towards the client's loan balance, with any remaining balance refunded to the client by check, which may take additional time for delivery.

In disputes or chargebacks related to cancellations, it's essential to resolve these issues and ensure Pathpoint receives the return premium to finalize the refund process. Pathpoint will not process refunds for programs with active disputes. Additionally, disputes may extend the refund timeline due to the bank's investigation, which can take 2-3 months. For questions about cancellations or refunds, please contact your Service Representative.

For additional information, you can visit Ascend's page on Cancellations and Disputed Charges.

Related Articles

Ascend- Cancellations and Refunds

How do I find Minimum Earned Premium (MEP) or the estimated pro-rated refund amount?